Together, we achieve goals.

What's your today?

20 results

News and articles

Productive unit and insolvency proceedings: the most effective way to save companies

European Directive 2019/1023 on restructuring and insolvency, transposed into Spanish law with the reform of the Insolvency Act in 2022, has as one of its objectives to promote the sale of productive units in order to encourage the continuity of companies and avoid liquidation in insolvency proceedings, as has been the case in most proceedings in recent years.

What can the dismissal of a worker in a situation of Temporary Incapacity mean for companies?

On July 14, the Law 15/2022, of July 12, came into effect. This law aspires to be the backbone of anti-discrimination law in our country, extensively developing various fields of action derived from Article 14 of the Constitution, which aims to guarantee and promote the right to equal treatment and non-discrimination of people.

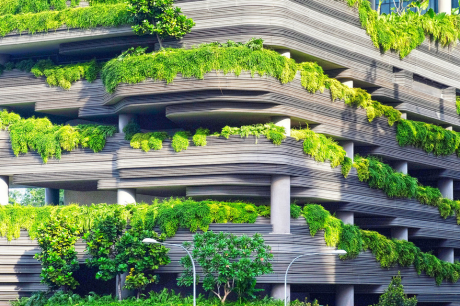

Renovating buildings: a technical, social and sustainable perspective

In recent years, renovation has become one of the main areas of focus in the field of architecture and construction. The need to extend the useful life of buildings, improve their energy efficiency and preserve existing heritage has led to a new professional and civic awareness. However, renovating a building is no easy task: it involves understanding, respecting and transforming what already exists. It is a complex operation, fraught with constraints that go far beyond pure technical execution.

DANA: Urgent measures for damages approved - RDL 6/2024 - Administrative, civil and commercial fields

In the BOE of 6 November, and with effect from 7 November 2024, Royal Decree Law 6/2024 has been approved, introducing a package of urgent measures to mitigate the effects of the DANA which, between 28 October and 4 November 2024, caused significant damage in several regions of Spain, including the Valencian Community, Castilla-La Mancha, Andalusia, Catalonia, the Balearic Islands and Aragon.

Directive on corporate sustainability due diligence approved

The European Parliament and the Council have reached an agreement on the Directive on corporate sustainability due diligence, which represents a significant step forward for the protection of the environment and human rights in the business sector.

Pensions and contributions in 2026: main changes

2026 marks a new step in the reform of the pension and social security system. The measures coming into force respond to a clear objective: to guarantee the sustainability of the public system in the context of an ageing population.

Personal income tax deduction reduced to 50% for new rental contracts from 2024 onwards.

The recent Housing Law introduces personal income tax (IRPF) tax incentives for new rental contracts for primary residences, with the aim of stimulating the supply of affordable prices. These rebates, which can reach up to 90%, came into force on 1 January 2024, but are conditional on the declaration of stressed market areas by the Autonomous Communities, none of which have done so until now.

Engineering for sustainable development

The commitment of European states to meet the Sustainable Development Goals (SDGs) highlights the need for many changes in the current way of doing things, both by governments and businesses. However, the need to achieve objectives by 2030 and 2050 requires an action plan that will need the knowledge of many professional groups. I will focus on the field of engineering in all its specialties, undoubtedly one of the most significant contributors to the proper development of these obligations.

Legislative news

RDL 16/2025: Social, Tax, and Social Security Measures

Royal Decree-Law 16/2025, of 23 December, extending certain measures to address situations of social vulnerability and adopting urgent measures in tax and Social Security matters.

This Royal Decree-Law extends various measures aimed at addressing situations of social vulnerability, with the goal of protecting the groups most affected by the current economic context. It also introduces urgent measures in tax and Social Security matters, aimed at ensuring system stability and support for individuals and businesses. The regulation maintains and adapts existing social protection instruments and introduces temporary fiscal adjustments.

RDL 2/2026: Urgent measures on social vulnerability and tax matters

RDL 2/2026 of 3th February introduces urgent measures to protect people in situations of social vulnerability, address tax issues, and manage resources of territorial financing systems.

RDL 3/2026: Revaluation of Public Pensions and Other Urgent Measures Regarding Social Security

Royal Decree‑Law 3/2026, of February 3, establishes the revaluation of public pensions for 2026 with a general increase of 2.7 % and higher increases for minimum, non-contributory pensions and the IMV, and includes other urgent measures regarding Social Security, such as adjustments to contributions and technical measures for the system.

All interns will pay contributions as of 2024

Starting January 1, 2024, all companies will be required to register interns with Social Security, regardless of whether they are engaged in paid internships or not.