Together, we achieve goals.

What's your today?

20 results

News and articles

Alternative plans for earth hour blackout

The movement that Grup Carles joins for Earth Hour consists of turning off the lights for one hour on Saturday, March 26, from 20:30 to 21:30. This gesture is an excellent opportunity to reflect on what each of us can do from home to contribute to the fight against climate change. It's an occasion to see how these small efforts, added to those of millions of people of different ages and cultures in more than 10 countries, can make a big difference and can turn an insignificant impact into significant energy savings.

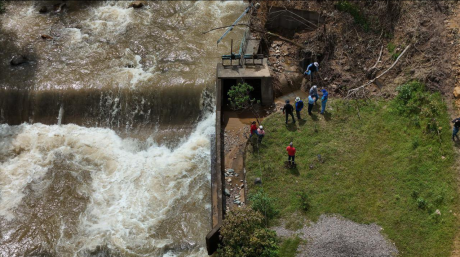

We are starting a new project: Updating irrigation systems in the province of Azuay, Ecuador

We are talking about the international project in Ecuador. Grup Carles Enginyeria i Sostenibilitat.

The digital euro: benefits and risks for citizens

Social Security contribution rebate for R&D&I activities

The Social Security contribution rebate for R&D&I activities is one of the most immediate and least known measures to support innovation among companies.

DANA: Labour measures for "DANA" damage approved - RDL 6/2024

Slurry: the environmental challenge we cannot ignore

New hiring incentives

This past January, Royal Decree Law 1/2023 was published, establishing a significant number of bonuses aimed at promoting the hiring of certain profiles, such as people with disabilities, victims of gender violence or human trafficking, people at risk of social exclusion, long-term unemployed or victims of terrorism, as well as young people under 30 years old who are beneficiaries of the National Youth Guarantee System.

Is equality in the company a reality yet?

Our society is increasingly aware of issues related to equality. As a result, both the administration and workers are demanding more procedures and mechanisms from organizations to guarantee equal treatment and opportunities, and non-discrimination based on sex, sexual orientation, gender identity, or gender expression.

Legislative news

RDL 16/2025: Social, Tax, and Social Security Measures

Royal Decree-Law 16/2025, of 23 December, extending certain measures to address situations of social vulnerability and adopting urgent measures in tax and Social Security matters.

This Royal Decree-Law extends various measures aimed at addressing situations of social vulnerability, with the goal of protecting the groups most affected by the current economic context. It also introduces urgent measures in tax and Social Security matters, aimed at ensuring system stability and support for individuals and businesses. The regulation maintains and adapts existing social protection instruments and introduces temporary fiscal adjustments.

RDL 2/2026: Urgent measures on social vulnerability and tax matters

RDL 2/2026 of 3th February introduces urgent measures to protect people in situations of social vulnerability, address tax issues, and manage resources of territorial financing systems.

RDL 3/2026: Revaluation of Public Pensions and Other Urgent Measures Regarding Social Security

Royal Decree‑Law 3/2026, of February 3, establishes the revaluation of public pensions for 2026 with a general increase of 2.7 % and higher increases for minimum, non-contributory pensions and the IMV, and includes other urgent measures regarding Social Security, such as adjustments to contributions and technical measures for the system.

All interns will pay contributions as of 2024

Starting January 1, 2024, all companies will be required to register interns with Social Security, regardless of whether they are engaged in paid internships or not.