Together, we achieve goals.

What's your today?

29 resultsNews and articles

In 2024, Social Security contributions will increase due to the rise in the MEI percentage.

News on aid for the purchase of houses

Recently, the central government approved the ICO guarantees to facilitate the purchase of primary residences for young people under the age of 35 and families with dependent minors. This guarantee will allow financial institutions to grant mortgages of 100% of the purchase price, when the necessary income limit requirements are met.

Benefits of sharing lunches with colleagues

In today's bustling work world, where time becomes a scarce resource, the idea of going out for lunch with colleagues might seem like a luxury or even an unnecessary distraction. However, this practice has significant benefits that go beyond merely satisfying hunger.

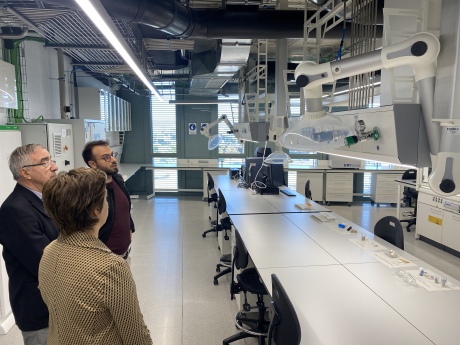

Grup Carles collaborates in the creation of one of the most important hydrogen and photovoltaic laboratories in Catalonia

It is a commission from the Polytechnic University of Catalonia to study how to improve the generation of renewable energies

The second chance mechanism: another future without debt is possible

Yes, debts are not for life; debts can be canceled, and a fresh start can be made.

The second chance has been in force since 2013 for individual entrepreneurs and since 2015 for any non-entrepreneurial individual. It may not be, from a technical point of view, and in my opinion, the best possible second chance law, but it is a law that allows for the exoneration of debts, and that is what is important. The law must be useful and functional, and for this reason, it must be utilized so that thousands of over-indebted, insolvent individuals can achieve the exoneration of their debts and start again as active members of society.

Retaining talent is not just a question of salaries; we analyse the case of Anoia

In recent years, the Anoia region has been experiencing a phenomenon that is worrying both businesses and institutions: many people who live there choose to work outside the region, especially in Barcelona and Baix Llobregat.

Traditionally, we have justified this by convincing ourselves that local companies can hardly compete in terms of salaries with those in the metropolitan centre. But reducing everything to a question of money is wrong.

Retaining talent is much more complex, and the key lies in how companies manage people, what work experience we offer and how we project the future within our organisations.

Renovating buildings: a technical, social and sustainable perspective

In recent years, renovation has become one of the main areas of focus in the field of architecture and construction. The need to extend the useful life of buildings, improve their energy efficiency and preserve existing heritage has led to a new professional and civic awareness. However, renovating a building is no easy task: it involves understanding, respecting and transforming what already exists. It is a complex operation, fraught with constraints that go far beyond pure technical execution.

Technology, efficiency and comfort: how we have promoted the new Apinas residence

Today, we are proud to announce that the Apinas residence is now fully operational. Below, we detail some of the most notable installations we have carried out in this building.

Legislative news

New Veri*Factu Regulation

Royal Decree 1007/2023: Approval of the Regulation that establishes the requirements to be adopted by the computer or electronic systems and programmes that support the invoicing processes of entrepreneurs and professionals, and the standardisation of invoicing record formats.

RD 254/2025: Extension of the deadline for adapting the systems to the new electronic invoicing regulations.

Royal Decree 254/2025 extends the deadline for entrepreneurs and professionals to adapt their IT systems to the requirements of the new electronic invoicing regulations. This measure seeks to facilitate progressive compliance with the obligations.